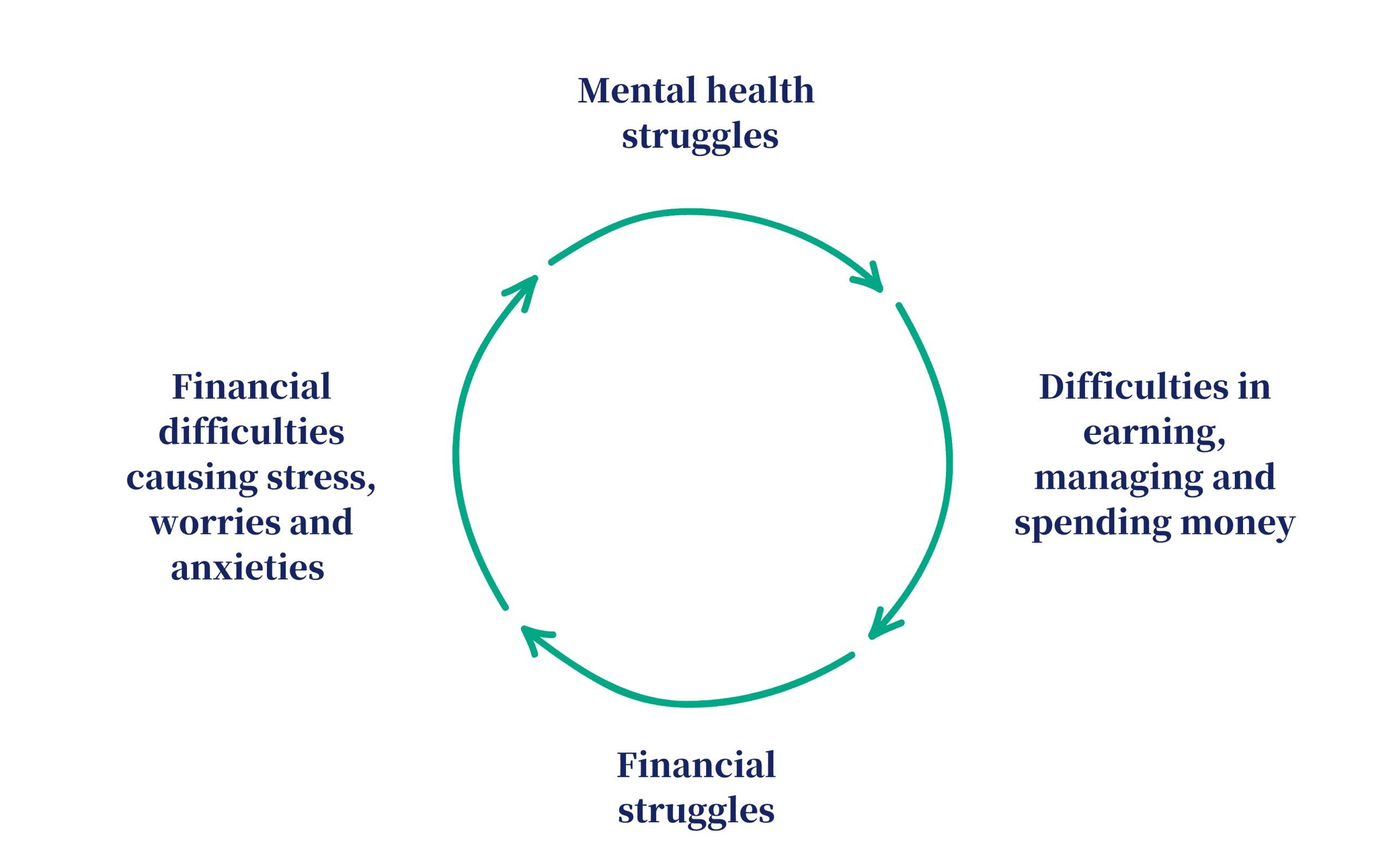

Financial stress is a form of emotional discomfort that is closely related to money. It can result from a low income that does not allow you to meet your needs or support yourself. When your financial stress becomes (more) intense, you might experience negative consequences on your mental and physical health.

From financial difficulties to stress and anxiety…

Financial difficulties are a common cause of stress and anxiety. This is a natural response when you are not able to afford the things you really need in your life, including housing, food, heating, or treatments such as medication or therapy. Money problems can also affect social life and relationships. You might feel lonely, ashamed, or guilty for needing support.

When our viability feels endangered, our brain is wired to get into ‘action mode’ to preserve our well-being. Back in the day, this was great. This alertness prepared our bodies to fight or flee (for example, running away from a bear) in order to ensure our own and our beloved’s safety.

Nowadays, we get the same activating trigger. However, the actions needed to get out of financial struggles require a different commitment from escaping a bear. This form of chronic activation often leads to behavioural changes and physical symptoms such as anxiety and depression, headaches, sleep issues, and other stress-related problems.

…from stress and anxiety to financial difficulties

Common symptoms of mental well-being challenges, such as increased impulsivity, difficulty paying attention, and memory deficits, make it harder to keep on top of financial management. For instance, you might find it harder to take budgeting and spending decisions, increasing the likelihood of financial difficulties.

In addition, once your cognitive resources are depleted, it becomes way more difficult to say no to temptation. You might buy things you don’t need in an effort to make yourself feel better, only to come to regret it later.

“Just think about a very long day at work where you had to use all your brainpower”, points out Paul. “Aren’t you way more likely to order some food instead of making your own healthy meal after a day like that, compared to a day where you had time to relax?”

Often, if we are already stressed and not in great financial shape, we are prone to make financial decisions that aren’t necessarily beneficial for us.

How to best cope with financial struggles?

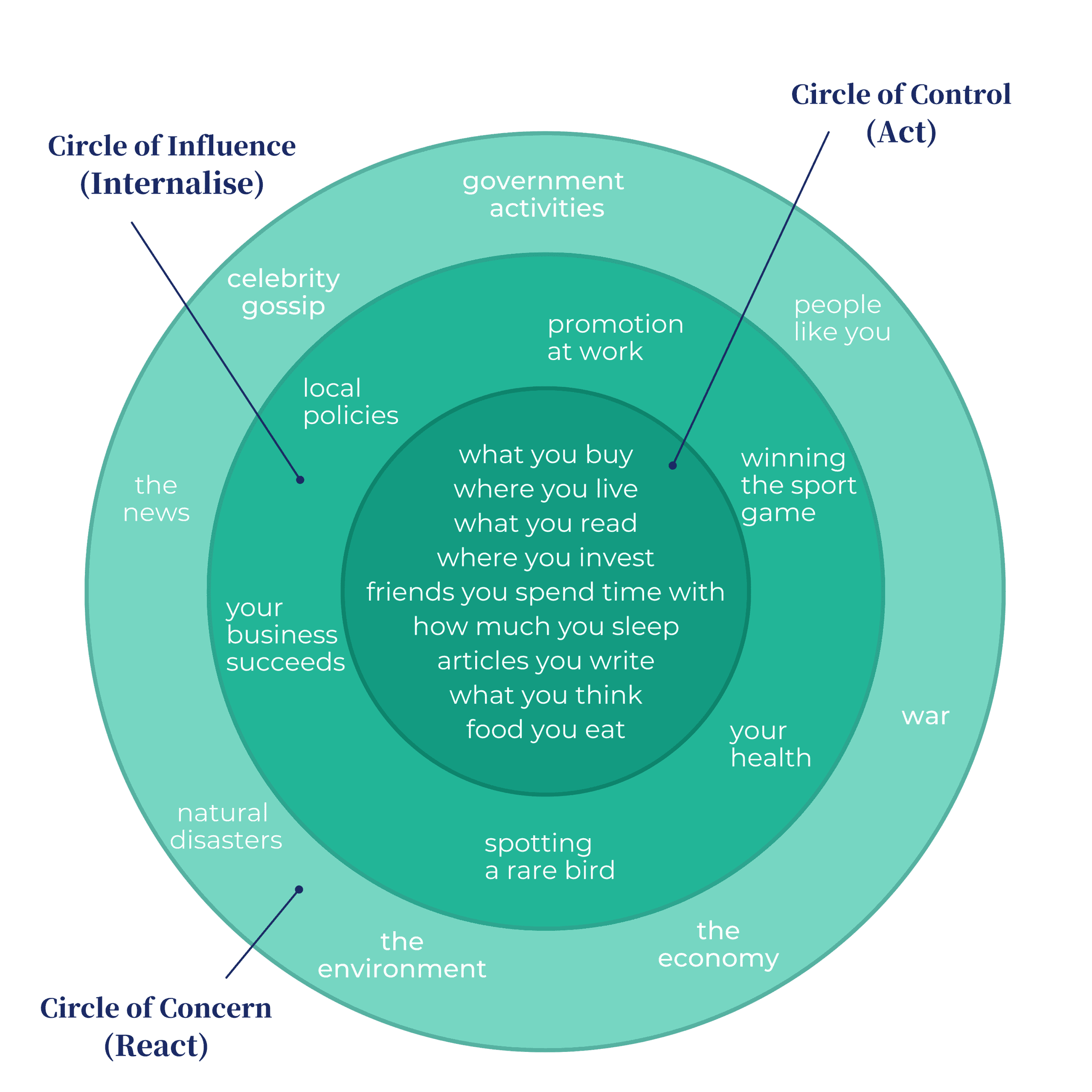

To feel more in charge of your life and create a more stable situation, it is important to learn to manage your finances and deal with financial tension. However, in order for you to have the right cognitive resources and mindset to tackle this challenge, it helps to try and lower your stress levels.

Below are some tips you can practice to mentally cope with financial struggles and take a step back from your worries:

1. Reach out for support

When facing financial issues, you may be tempted to try and handle your problems on your own. Perhaps you want to avoid bothering others or rather keep your situation private. While disclosing your salary or addressing financial concerns can feel uncomfortable, holding things up will only contribute to your stress. Communicating your worries with someone you trust, such as friends and family, can ease your burden and make it seem far less daunting.

👉 You might like: The Energy Crisis Is Putting Employees Under Financial Stress: Here’s How HR Professionals Can Help

In addition, speaking to an expert adviser about your financial situation helps you put things in perspective and identify possible solutions. Many organisations provide free financial counselling, whether it is debt management, budgeting, or financial assistance (see the section below for links).

Reaching out for support to help you out is an act of strength and care, both for yourself and your loved ones.